Just a gentle reminder before you start spending and using your credit cards for the holidays. Utah is overdue for an earthquake. Homeowners insurance specifically excludes damage from earthquakes so you need to protect your biggest financial investment by buying earthquake insurance. See the Utah Divison of Insurance info page on earthquake coverage: https://insurance.utah.gov/auto-home/home/earthquake.php Source:…

Month: November 2016

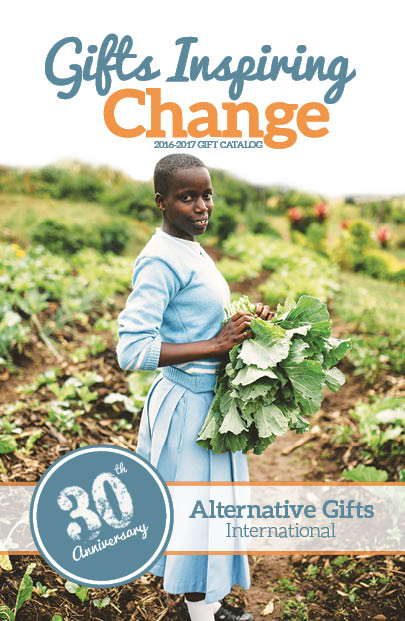

Alternative Gift Mart in Cache Valley Nov. 12

If you are tired of the holiday gift giving frenzy, it’s time to visit the Alternative Gift Market Give, in honor of a friend or relative, an alternative gift of food, medicine, livestock or education. These gifts will be sent to areas with great needs around the world and here at home. When you purchase…

Recommended Financial Author and Newsletter

One of my favorite resources for consumer-oriented financial and investing advice is Jonathan Clements. Check out his website: http://www.jonathanclements.com/ with his excellent books. You can sign up for a monthly newsletter: http://www.jonathanclements.com/sept-2016-newsletter Source: Financial Planning for Women

FINANCING AN AUTOMOBILE

Taking out a loan to purchase an automobile can be a significant part of consumers’ financial lives. And it is a complicated process. The decision to obtain auto financing includes many factors, including the source of financing, features of the loan, and issues related to down payment, trade-in, and add-ons. To help consumers navigate this…

Financial Resources for Parents from CFPB

RESOURCES FOR PARENTS Parents and caregivers want to put their children on a solid path to a bright financial future – but they’re not always certain about what to do and when. The CPFB has launched the new Money As You Grow Web site, where we provide a framework for how children develop financially, along…

Help for Identity Theft Victims

IdentityTheft.gov now makes it easier for victims of identity theft to report it and recover from it. New features on the site allow people to: Get a personal recovery plan that walks them through each step Update their personal plan and tracktheir progress Print pre-filled letters & forms to send to credit bureaus, businesses, and…

TOOLS FOR FINANCIAL CAREGIVERS

Millions of Americans are managing money or property for a loved one who is unable to pay bills or make financial decisions. This can be very overwhelming. But, it’s also a great opportunity to help a loved one and protect them from scams and fraud. The CPBP Office for Older Americans has resources for financial…